YOUR FINANCIAL SUCCESS IN GOOD HANDS

Boost your small business with our expert accounting and custom tax solutions.

SERVICES

We are here to help you

Find out the difference when declaring your taxes with us

What documents should you bring to your tax appointment?

OURPHILOSOPHY

Treat our clients

as we would like to be treated, with honesty, efficiency and professionalism. In our office we continuously train ourselves to offer excellent service.

OURTEAM

Liliana Cuellar

Bachelor of Arts (BA) in

Accounting

Carlos Bedoya

Bachelor of Arts (BA) in

Accounting

Paula Zarama

Bachelor of Arts (BA)

in Psychologist - Translator -

Assistant

Mayra Ibáñez

Bachelor of Arts (BA)

in International Business -

Assistant

Martha Pause

Bachelor of Arts (BA) in Business Administration - Tax Expert

CEO - Founder

/

FAQS

Who must file taxes in the United States?

In general, anyone who has income in the United States, whether from a job, investments, businesses, or any other source, is required to file taxes. However, there are some exceptions, such as people who have incomes below a certain threshold, or people who are exempt from taxes for religious or other reasons.

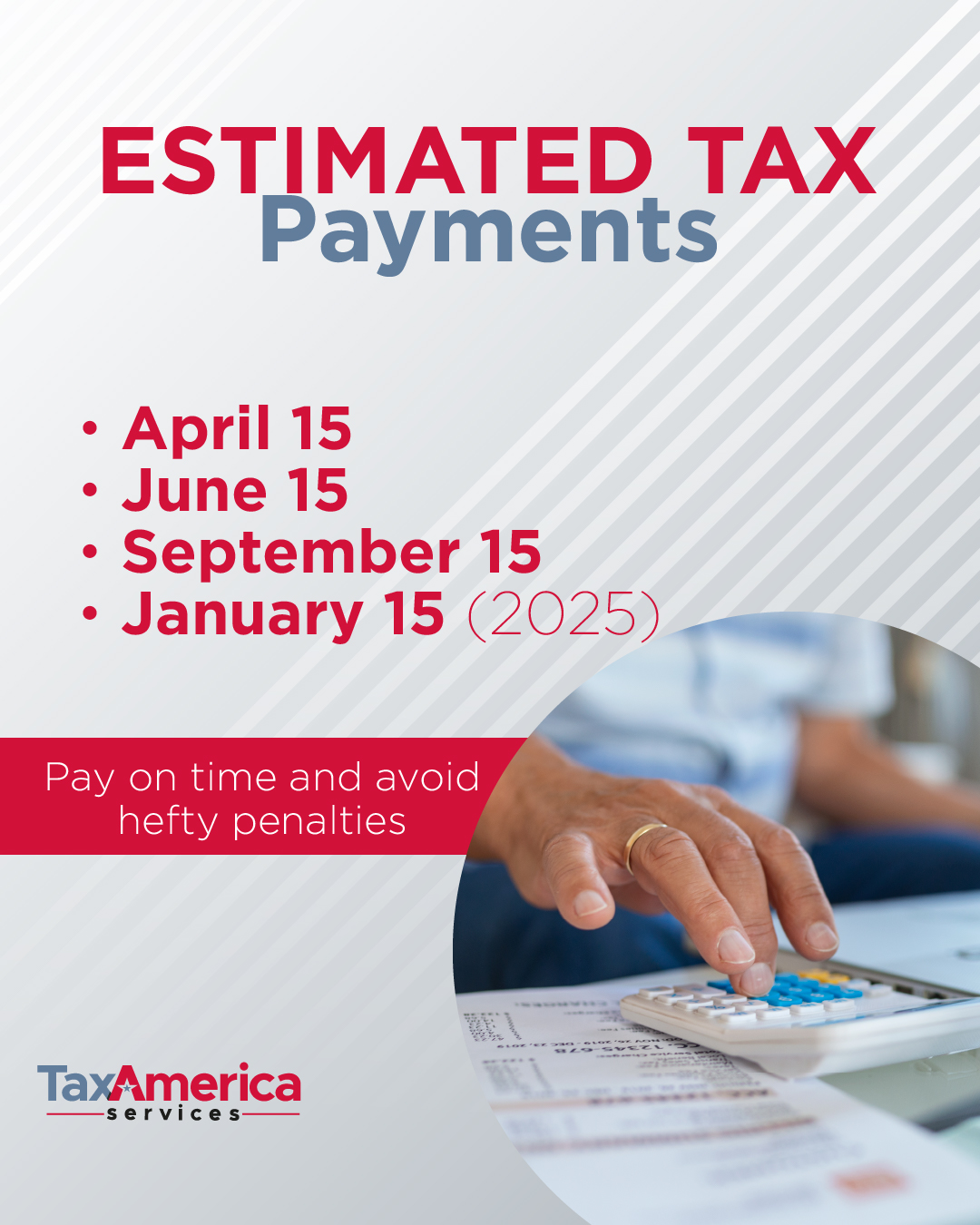

What is the due date to file the tax return?

The due date for filing your federal personal income tax return is generally April 15 of each calendar year. However, there are some exceptions, such as people who live in Alaska, Hawaii, or certain island areas of the United States.

How can I file my tax return?

There are several ways to file your taxes. You can do this online, by mail, or with the help of a professional tax preparer. If you file online, you can do so through the Internal Revenue Service (IRS) website. If you file your return by mail, you must send it to the IRS by the due date. If you file your return with the help of a professional tax preparer, he or she will file it on your behalf.

What information do I need to file my tax return?

To file your tax return, you will need to gather certain information, such as your tax identification number (TIN), your gross income, your deductions and exemptions, and any other tax credits you may be able to claim. You can find this information on your income statements, your expense receipts, and other documents related to your finances.

What happens if I don't file my tax return?

If you do not file your tax return on time, you may be subject to fines and penalties. Penalties can vary depending on the amount of taxes owed and the severity of the violation. In some cases, the IRS may garnish your wages or assets to collect taxes owed.

Should You Hire a Tax Preparation Specialist?

YES, for these reasons:

Accuracy: Tax preparers are trained to understand the complex tax laws of the United States.

Saving time: Tax preparation can be a complex and tedious task.

Trust: Tax preparers are required to maintain the confidentiality of taxpayer information.

×

Send